As gross gaming revenue (GGR) in the special administrative area (SAR) improves, some traders are betting that those gaming names have more upside ahead. A commonly used indicator of Macau casino stocks is up over 60% from its April low.

With the help of nongaming attractions like well-known concerts and infrastructural upgrades that make it easier to reach from mainland China, GGR, the biggest casino hub in the world, has been waking up and bolstering stock rallies that market players had previously ignored.

"This (the June GGR report) is stronger than expected, thanks to the Jacky Cheung concerts and the continuing high VIP win rate,” wrote Jefferies analyst Anne Ling in a report out earlier this month. “Moving into the month, with the ending of Jacky Cheung concerts, the event calendar seems light MoM, with Aaron Kwok on 12-27 July and Sandy Lam on 19-27 July.”

Premium mass players are driving better performance at Macau casino resorts, according to Ling, which is positive because those visitors aren't simply gamblers. Instead, people come to Macau for non-gaming activities like shopping, dining, and entertainment.

Macau Casino Stocks Are Expected to Rise During the Earnings Season

The gaming industry's second-quarter earnings season is already underway, and if Las Vegas Sands' (NYSE: LVS) report from last week is any indication, Macau-related stocks may be set to see short-term growth.

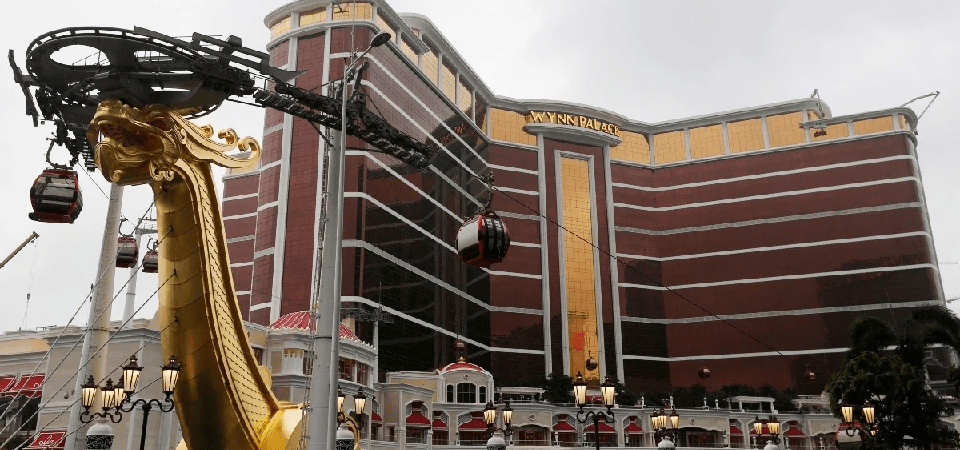

The stock saw its strongest intraday performance in months after Sands China's parent firm produced outstanding Macau results, which is encouraging given that it operates five integrated resorts there. Wynn Resorts (NASDAQ: WYNN) and other Macau operators who have not yet reported may find that to be excellent news.

The idea that Macau casino stocks are cheap in relation to EBITDA gains is further supported by the expectation that concessionaires will produce earnings before interest, taxes, depreciation, and amortization (EBITDA) beats.

“Nonetheless, the setup for stocks appears to be improving, with EBITDA valuations in the ~8-10x range and better-than-expected growth,” adds Ling.

According to her, her favorite names are Galaxy Entertainment from the Hong Kong-listed company and Sands from the US-based Macau operators.

The Reasons Sands May Lead Macau Casino Stocks

The three US-based concessionaires in Macau are Wynn, Sands, and MGM Resorts International (NYSE: MGM). Given that it exclusively operates in Macau and Singapore, where its Marina Bay Sands is among the most lucrative gaming establishments globally, Sands might be the most pristine of the three stories.

Although Wynn is more of a Macau story, MGM may find that its position as the biggest operator on the Las Vegas Strip, where visitor numbers are declining, dampens interest in its Macau exposure. That might be one of the reasons why US investors favor Sands as a Macau investment.

“LVS remains a top Macau pick given its strong management team, capital returns, leading position in mass, and unrivaled capacity (i.e., rooms, tables, nongaming),” observes Macquarie analyst Chad Beynon. “Additionally, Singapore continues to be an impressive source of strength and earnings.”