A new year has arrived, bringing optimism for more states to legalize iGaming; however, one industry expert thinks the rate of these approvals will differ from the pattern observed with online sports betting.

In a recent discussion with Deutsche Bank analyst Carlo Santarelli, Richard Scheutz, who has over forty years of experience in the gaming industry, noted that state approvals for internet casinos will not come at the rate observed with sports betting. Scheutz, the CEO of American Bettors’ Voice (ABV), cited possible cannibalization of brick-and-mortar (B&M) casinos as one reason states are hesitant to endorse iGaming.

"B&M opposition to iCasino, which was always present, has increased, in the aftermath of both Pennsylvania and Michigan legalizing the product, and thereby giving operators more data from which to support / frame an opinion on the magnitude of B&M cannibalization stemming from the product,” wrote Santarelli.

At present, only seven states — Connecticut, Delaware, Michigan, New Jersey, Pennsylvania, Rhode Island, and West Virginia — permit online casinos. That is in contrast to 38 and Washington, DC which allow certain forms of sports betting. This year, Missouri enters that group, bringing the total to 39.

Don't Count on Significant iGaming Growth in 2025

In a report released earlier this week, Santarelli remarked that a surge of state-level approvals for iGaming is improbable this year.

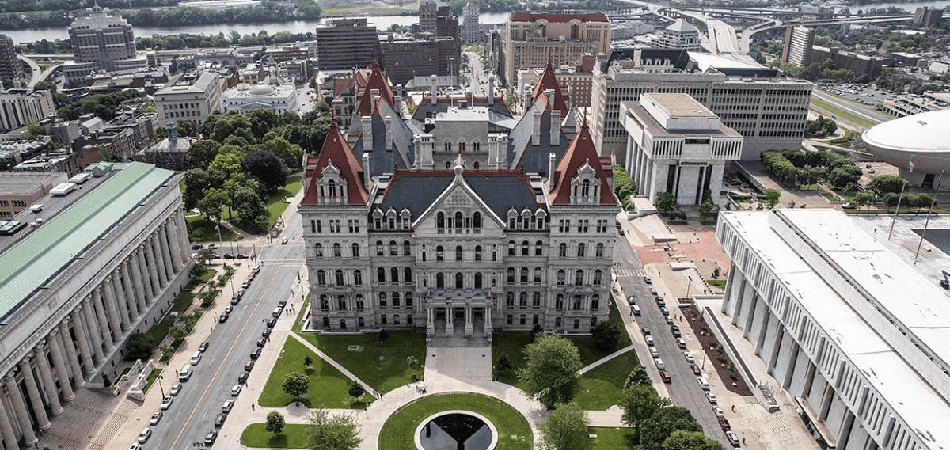

The analyst pointed out Illinois, Indiana, Maine, Maryland, New York, and Ohio as possible candidates for related legislation, observing that the highest chances of approval are in Maryland and Ohio. The industry and investment sector would probably be fairly pleased with that result as it would show advancement, but there would still be some degree of letdown if neither Illinois nor New York — the two biggest states in that category — adopts internet gambling.

Wyoming is another potential contender to legalize iGaming this year, but as the smallest state in the country, its impact on wider approvals will likely be minimal.

Santarelli observed that the investment community probably shares Scheutz's perspective that terrestrial casinos pose obstacles for iGaming, and wider acceptance of that type of gambling is unlikely to occur this year.

California, Texas Remarks

Scheutz and Santarelli also talked about the prospects for California and Texas to be added to the list of states permitting sports betting. A few years back, the ABV CEO was one of the initial critics of the 2022 ballot initiative from commercial operators aiming to legalize sports betting, and he turned out to be right as voters decisively rejected that proposal.

He informed Santarelli that it seems operators have grasped their lesson and now understand that the sole route to sports betting in California is via, not bypassing, tribal casino operators.

“Mr. Schuetz is of the view that the tribes will work through balance of power issues, with the potential for a sharing of proceeds agreement, while the OSB operators primarily serve to provide brand equity and technological and operational expertise,” said Santarelli.

Regarding Texas, Scheutz informed the Deutsche Bank analyst that sports betting might gain traction this year if it helps in the initiative to establish Las Vegas-style casino resorts in the state. There are favorable conditions for that strategy because of the substantial resources of Las Vegas Sands (NYSE: LVS) investor Dr. Miriam Adelson, but it is unclear whether Lt. Gov. Dan Patrick (R) will alter his stance on gaming expansion — a scenario that seems improbable for the time being.

For sportsbook operators, Texas represents a better choice than California since it would create a competitive market without required concessions for tribal gaming groups.